Comeback of travel to and from China: Is the aviation industry prepared?

The Good News

China has revoked its stringent quarantine for inbound travelers starting January 8, 2023. This is good news for international travelers to and from China. Recent long waiting times at US and European embassies and consulates in China shows the desire of Chinese people to travel abroad has been re-ignited by the relaxing of travel restrictions. Moreover, as the pandemic subsides significantly, it is time for many overseas Chinese and business people to visit China again.

What is the impact on the aviation industry?

According to the World Tourism Organization, the number of international tourists arriving in China dropped by over 100 million passengers from 2019 to 2022. If the number of Chinese travelers comes back to its pre-pandemic levels, the aviation industry will need to prepare for millions of Chinese air travelers to re-enter the market. Just as the scheduled flights of the domestic market almost returned to their pre-pandemic level during the Chinese New Year, we estimate that similar demand for international air travel will return with the “Chinese Speed”.

However, are airlines and aircraft manufacturers ready for this?

To start with, due to the cost and environmental concerns, major carriers in the world have replaced or are in the process of replacing their four-engine long-haul aircraft such as Boeing 747 and Airbus A380 with two-engine aircraft such as Boeing 787, Airbus A350 or A330. A typical example is that British Airways phased out its thirty-two Boeing 747-400 aircraft between 2019 and 2021. To compensate for the loss of capacity, British Airways introduced a mix of Airbus A350, Boeing 777 and 787 during the same period, according to its annual reports. However, the Boeing 747-400 typically has more than 420 seats and the Boeing 787-10 and the Airbus A350-900 usually have 60 to 80 fewer seats. Even if British Airways replaced the Boeing 747-400 fleet with the same amount of Boeing 787 or Airbus A350, the reduction of seat capacity in long-haul operations would be significant.

Secondly, how much “spare capacity” do the airlines have? During the pandemic, many airlines stored their wide-body aircraft. But can these parked aircraft come back into service once the demand is there? From our research over the five “old generation” aircraft types with high inactivity ratios, most of the Boeing 747-400, 767-300 ER and 777-200ER fleets appear to have reached the edge of their economic life. Even if they can serve one or more seasons, they will reach the end of their useful life in the foreseeable future.

The inactive Airbus A330-200 fleet seems to be in a better position with a much lower average fleet age. The re-activation of A380 requires much more careful calculation. The airlines have to decide whether they just need to cover the operation for this summer or will integrate these aircraft into their fleet for long term operations. These four-engine aircraft are much more expensive to operate compared with their two-engine rivals and riskier to hold in a turbulent market.

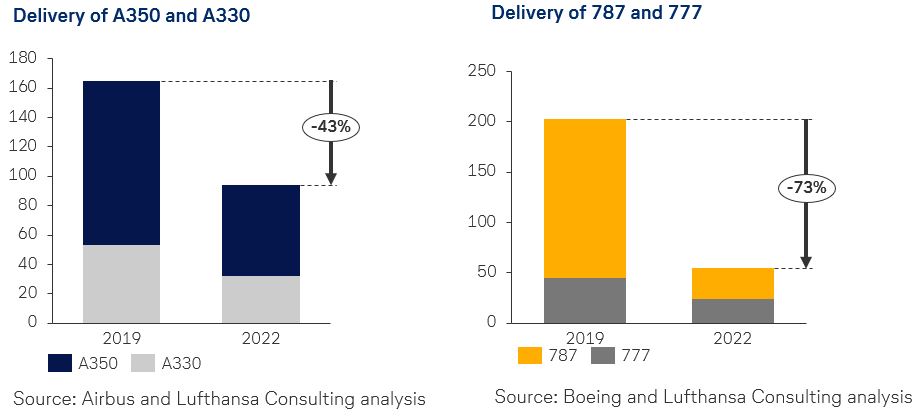

The final option is to buy new aircraft. As per Airbus’ website the number of deliveries of A330 and A350 dropped from 53 to 32 and from 112 to 62 respectively between 2019 and 2022. Boeing showed an even gloomier picture on their website with the total delivery of its 777 and 787 dropping by over 70% between 2019 and 2022. On one hand, such a delivery drop was driven by the sharp drop in demand due to the pandemic. The expected increased demand will lead to an increase in the production rate. On the other hand, the drop in long-haul aircraft demand was profound and lasted too long. It will be a big challenge for the aircraft manufacturers and their suppliers to dramatically recover or even exceed their previous delivery rate.

In summary, we estimate that the return of travelers to and from China will boost the profitability of the aviation industry due to the strong market demand. The recent purchase of 72 787-9 Dreamliners by new Saudi Arabian Carrier Riyadh Air may further strengthen the competition for new aircraft production slots. With the tight supply of new long-haul aircraft, airlines need to start their procurement process early and evaluate their options carefully when they acquire the capacity.

Read the article with more graphics here!

Lufthansa Consulting with its dedicated aircraft acquisition advisory team and cooperation partners supports its clients in managing their complete aircraft procurement process, evaluating different options and negotiating with OEMs and lessors to achieve the most value-add solutions.

Authors: Haihong Xu, Senior Consultant, and Vincent Hütte, Associate Partner